Editorial

Different Scams You Should Be On The Lookout For This Season

It’s a pandemic season and one can not too be careful. It’s a perilous time, everyone is trying to transact from their homes, businesses are also adjusting their processes and it is a perfect time for fraudsters to strike unsuspecting persons.

1:— THE HELPFUL ADHOC STAFF

I put this first because they thrive whenever there is rush/staff shortage. Currently people are trying to sort out their transactions because they fear banks might close. Happens right inside the banking premises and real fast too. They come dressed in suits, looking like your everyday banker. They approach customers with bulk deposits and offer to help them. Trust Nigerians with wanting to jump the queue- they quickly hand over the money and that is it…

-Do not give your money to anyone who isn’t across the counter (and) with an ID.

2:— A STRANDED COMMUTER

This one wouldn’t leave you penniless, it is in fact worse as it can land you in Alagbon. After stealing phones of people, they start looking for pickers. They’ll typically approach you at ATM points with a sob story of not having debit cards but needing urgent cash for transport fare to Kuvukiland. They request for your account number so they transfer and you withdraw for them. Some are even kidnappers. Next thing your account gets flagged for something you know nothing about. They have different stories, but the goal is always the same- to use your account for inflows. Even your friends are not to be trusted.

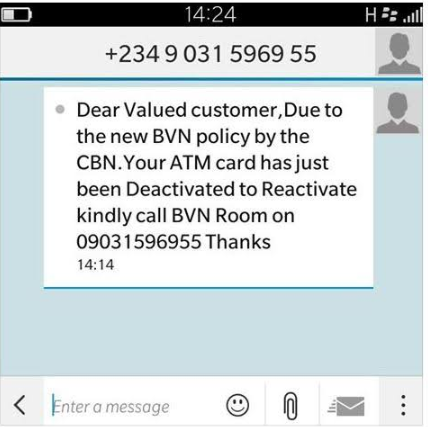

3:— THE BVN CUSTOMER CARE REP

A very old method, but somehow people still fall for it. Majority of us must have gotten those calls from a supposed customer care representative. They would always claim your account has been blocked and you need to provide some details to have it unblocked.

-The bank would never call to ask for sensitive account details.

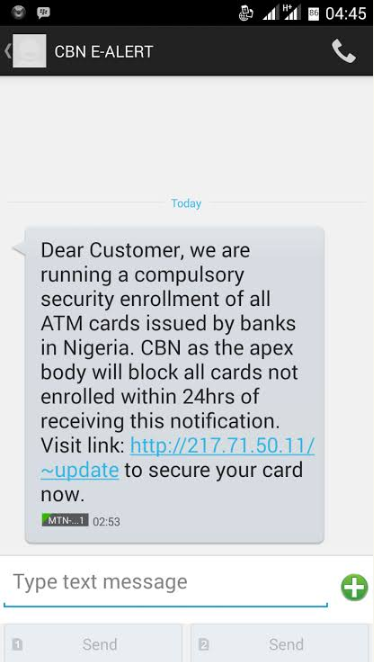

4:— PHISHING

This is also used for BVN scam, but for persons with internet enabled phones. They clone the design of the Bank, its color, logo…etc. Then send a customized mail to the customer, directing you to some other link where you would be required to fill in your details. PLEASE DON’T.

5:— DEBIT CARD SWAP

Fraudsters are also big on ATM scam. They stand at ATM points to feign assistance to vulnerable users – illiterates, the old and the physically challenged. They later swap cards to defraud them. That is after ensuring the fake card has been retracted. Best done during weekends when customers can’t run to the bank for help. KNOW YOUR BANK’S HELPLINE.

6:— FAKE ALERT

Now that a lot of businesses are insisting on transfers and card payments, watch-out for this. It involves the use of SMS disguised as bank alerts to defraud unsuspecting victims.

7:— ERRONEOUS TRANSFER

Ever received a transfer from a strange account, only to get a call from someone- pleading that it was a mistake and you should help forward it to a third account? If you have ever done this and didn’t get into any trouble, you are in luck. Contact your bank for such.